AMD reports strong Q3 earnings in the wake of the crypto crash

AMD reports strong Q3 earnings in the wake of the crypto crash

AMD has stated that “Blockchain-related GPU sales in the third quarter were negligible” this quarter, drastically lowering the demand for Radeon graphics hardware, offsetting some of the gains made by AMD in the CPU market, where the company’s Ryzen and EPYC products have continued to be strong performers.Â

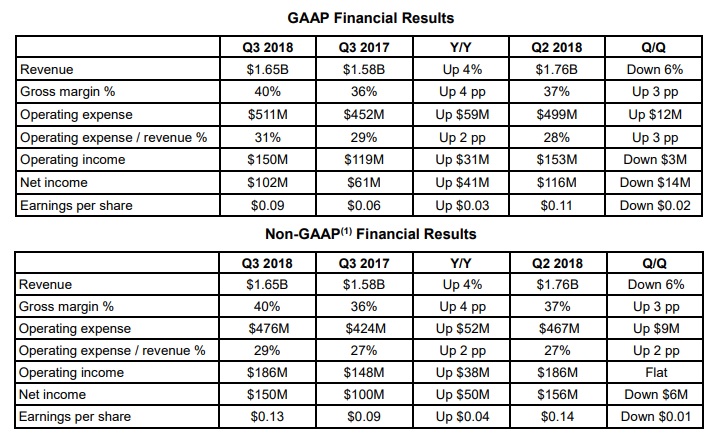

This quarter, AMD’s revenue was $1.65 billion, which represents a 4% increase Year-over-Year (Y/Y) and a 6% drop Quarter-over-Quarter (Q/Q). During this time, AMD’s Gross margins have increased to 40%, thanks mostly to AMD’s IP related revenues and the success of AMD’s high-margin EPYC and Threadripper series processors.Â

AMD’s joint venture with THATIC generated $86 million in revenue for the company, which when combined with “memory and inventory related adjustments” accounts for around 2% of AMD’s margin’s boost. It is likely that AMD’s IP related revenues will grow in the coming quarters.Â

Splitting things up into AMD’s major business units, we can see that AMD’s Computing and Graphics segment has a middling success, with 12% growth Y/Y and a 14% decline Q/Q. In this segment, AMD’s Ryzen processors have had strong sales, but the company’s Radeon graphics segment has seen a significant drop in revenue. AMD blames their poor Q/Q performance on “lower graphics revenue”.Â

AMD’s Enterprise, Embedded and Semi-Custom division earned revenues of $715 million, representing a decrease of 5% Y/Y and a 7% increase Q/Q. This Y/Y decrease is primarily due to lower semi-custom revenue, which makes a lot of sense given this year’s lack of new console launches/hardware releases. This revenue decrease is offset by higher server sales, which are driven by AMD’s EPYC processors. AMD’s Enterprise, Embedded and Semi-Custom Division has increased its operating income to $86 million, which is an increase both quarter-over-quarter and year-over-year. Â

While AMD’s financials may appear to be poor when compared to Q2, AMD has proven that they can increase their margins and maintain profitability despite weak Radeon/graphics sales. This is also the first time which AMD’s joint venture with THATIC has contributed to AMD’s quarterly revenue report, marking the start of what is likely to be a highly profitable partnership for the company.Â

Â

You can join the discussion on AMD’s Q3 Financials on the OC3D Forums.Â